If you’re a business owner investing in equipment, you’ve probably heard the term “100% bonus depreciation” tossed around. But what does it mean—and how can it help your business thrive this year?

In this post, we’ll break it down in plain terms and explore how this accelerated depreciation method may create powerful incentives to invest in equipment, all while making sure you speak with a tax professional before making any big moves.

*Disclaimer: This content is for informational purposes only and does not constitute financial, tax, or business advice. Always consult a professional before making any major financial or business decisions.

What is Bonus Depreciation?

Bonus depreciation allows businesses to deduct a significant portion—or in some cases, the full cost—of qualifying assets in the year they’re placed into service.

Historically, businesses had to deduct asset costs gradually over several years. But with bonus depreciation, you may be able to accelerate that deduction to maximize potential tax benefits up front.

The 100% Bonus Depreciation Window

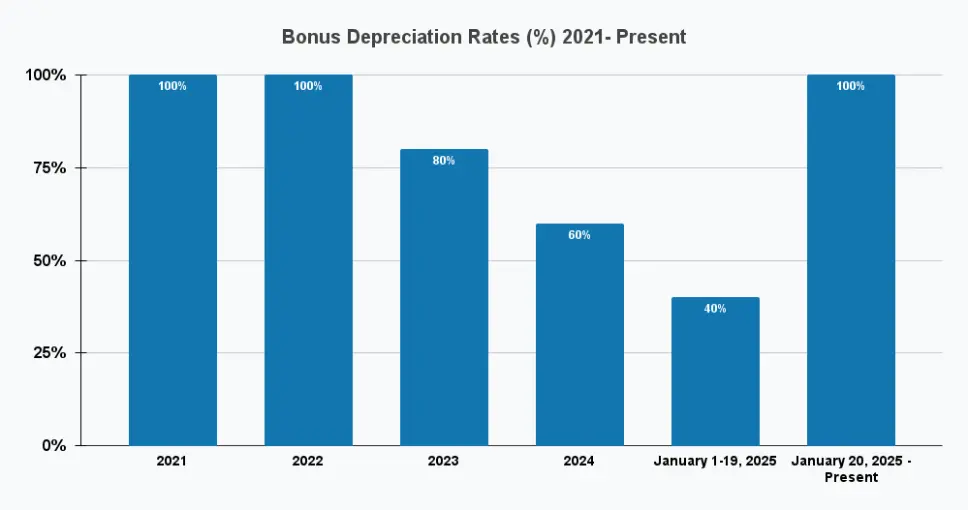

As of January 19, 2025, under the newly enacted One Big Beautiful Bill Act, businesses can once again deduct 100% of the cost of eligible new or used equipment in the year it’s placed into service. This revised law eliminates the previously scheduled phase-down, making the benefit permanent going forward.*

What Kind of Equipment Qualifies?

Generally speaking, bonus depreciation applies to tangible, depreciable business assets with a useful life of 20 years or less. This includes:

- Heavy construction equipment

- Commercial trucks

- CNC machines and fabrication tools

- Business-use vehicles

- Office technology and more

Used equipment may qualify too—as long as it’s “new to you” and meets IRS guidelines.

How Equipment Financing Ties Into This

If you’re planning a major purchase but don’t want to drain your cash reserves, financing the equipment while still potentially claiming full depreciation may be an option worth exploring.

We help businesses like yours secure the right equipment financing solution, quickly and with less red tape than traditional lenders. Whether you’re acquiring a bulldozer or a fleet of trucks, we help you move fast—and smart.

Act Now to Maximize Your Equipment Investment

While 100% bonus depreciation is now permanent, planning your equipment purchases strategically can still make a big difference. Investing sooner rather than later helps you take full advantage of the accelerated deductions and improves your cash flow—supporting faster growth and better financial flexibility.

Next Steps

Before moving forward, make sure you:

✔️ Consult your tax professional about how bonus depreciation applies to your business

✔️ Get pre-qualified for equipment financing to lock in low rates and fast approvals

✔️ Work with a partner who understands the nuances of equipment deals and timelines

Let’s Make 2025 Your Year of Growth

At Mak Global Corp, we go beyond your bank to deliver fast, flexible financing that supports your goals. We’re here to help you seize opportunities—not wait for them to pass.

All we need to start is an application, either from your vendor or our website and an equipment quote or invoice. We’ll hand the rest.**

📞 Ready to talk strategy? Contact Us and let’s find the right financing option for you.

**Please note: Additional documentation or information may be required depending on your credit profile, equipment type, or lender guidelines. Submission of an application does not guarantee approval. Our team will guide you through the process every step of the way.